Seriously! 19+ List About Call Spread Vs Put Spread Your Friends Forgot to Share You.

Call Spread Vs Put Spread | Why does the call debit spread net me less return for the same risk profile on the same stock? So basically, a vertical spread consists of the same number of short calls as long calls or the same number a bull put spread is a bullish credit spread and a bear put spread is a bearish debit spread. This is because the higher strike put that you sell is typically more expensive than the lower. A call spread requires an upward price movement, so use it when you're moderately bullish. Eric bank, mba, ms finance.

Trying to execute a swing trade on penny stocks would require an explosive move to realize the same gain (47.1%) in this example. The strike price of the short call it is interesting to compare this strategy to the bear put spread. For a bear put spread, traders buy the spread and therefore have. The one difference i think is valid is that using spread operator for large array size will give you error of maximum call stack size exceeded which you can avoid using the concat operator. Bull call spread vs bull put spread.

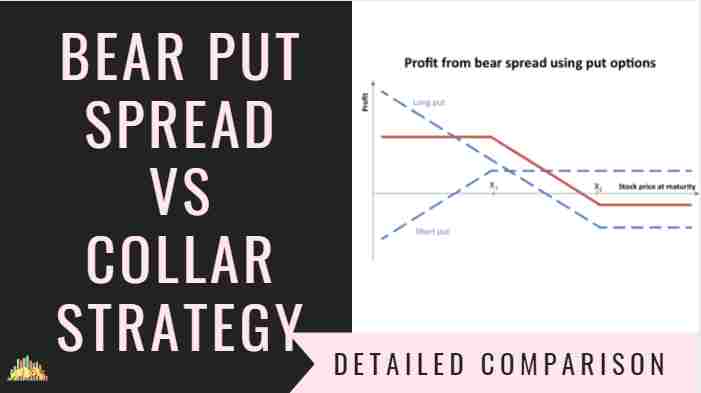

How would this put spread strategy compare with shorting call credit spreads on high implied volatility (iv) spikes? Compare top strategies and find the best for your options trading. Whereas, the bear put spread is a debit spread and will cost you money to buy it. If you enter a call credit spread, you win in 3 ways: A comparison of bull call spread and bull put spread options trading strategies. A put spread is an option strategy in which a put option is bought, and another less expensive put option is sold. These strategies are useful to … Bull call spread vs bull put spread. A bull call spread is established for a net debit (or net cost) and profits as the underlying stock rises in price. As time passes the spread increases in profitability. Eric bank, mba, ms finance. Here then are the similarities and differences of these two options. Aka bear call spread, vertical spread.

Here then are the similarities and differences of these two options. The best case scenario for a call credit spread is for the underlying instrument, stock xyz in this case, to move down or stay the same. The profit/loss payoff profiles are exactly the same, once adjusted for the net cost to carry. Bull call spread vs bull put spread. Whereas the stock price for this.

Why does the call debit spread net me less return for the same risk profile on the same stock? But what are the differences. A bull call spread consists of one long call with a lower strike price and one short call with a higher strike price. If an investor trusts that the price of a stock will move and is ready to invest and accept the potential risk, they may reap. As time passes the spread increases in profitability. Eric bank, mba, ms finance. That's looking at 37.7% return. A bear call spread is a type of vertical spread. So basically, a vertical spread consists of the same number of short calls as long calls or the same number a bull put spread is a bullish credit spread and a bear put spread is a bearish debit spread. A comparison of bull call spread and bull put spread options trading strategies. It consists of buying a like other options spreads, call debit spreads or bull call spread, is a bullish option trading i give the same advice for a put debit spread as well. Unlike bear put spread and unlike bull call spread (which is also bullish and has a similar payoff profile), bull put spread is a credit spread, which means the cash flow when opening the position is positive. A call spread requires an upward price movement, so use it when you're moderately bullish.

Options spreads are the basic building blocks of many options trading strategies. A comparison of bull call spread and bull put spread options trading strategies. Higher short options premium due to. Put spread greetings, want a copy of my market timing strategy guide for. Here then are the similarities and differences of these two options.

Put spread greetings, want a copy of my market timing strategy guide for. A short call spread obligates you to sell the stock at strike price a if the option is assigned but gives you the right to buy stock at strike price b. No prizes for guessing that these are both bearish trades and that one uses puts and the other users calls. Eric bank, mba, ms finance. A bear call spread is a type of vertical spread. A spread position is entered by buying and selling equal number of options of the same class on the same underlying security but with different strike prices or expiration dates. The long call option and long call spread (bull call spread) are two similar bullish options strategies. A comparison of bull call spread and bull put spread options trading strategies. These strategies are useful to … Trying to execute a swing trade on penny stocks would require an explosive move to realize the same gain (47.1%) in this example. Bull call spread vs bull put spread. Options spreads are the basic building blocks of many options trading strategies. Call vs put options are the two sides of options trading, respectively allowing … using call or put options as investment strategy is entirely a game of speculation and assumption.

Call Spread Vs Put Spread: Trying to execute a swing trade on penny stocks would require an explosive move to realize the same gain (47.1%) in this example.

Source: Call Spread Vs Put Spread

0 Response to "Seriously! 19+ List About Call Spread Vs Put Spread Your Friends Forgot to Share You."

Post a Comment